Navigating Rising Insurance Premiums: A Guide for Small-to-Medium-Sized Fleets

The transportation and logistics market faces several key challenges, including increasing customer expectations for faster and more efficient services, managing volatility in fuel and insurance costs, and the ongoing struggle to manage costs and optimize operations in a highly competitive environment. For small-to-medium-sized fleets, these challenges are particularly acute, given the limited margin for error in navigating how to reduce continuing increases in insurance premiums.

The significance of these changes is underscored by the vital role insurance plays in safeguarding valuable assets, employees, and the public. With costs on the upswing, small to medium-sized fleet operators are seeking strategies to mitigate these expenses without compromising coverage or safety.

This blog delves into the current trends of escalating fleet insurance premiums, identifying the key factors contributing to this surge, including the growing impact of nuclear verdicts, the role of telematics and dashcams in risk assessment, and the specific challenges faced by small fleets. It further explores practical strategies that can help mitigate insurance costs, highlighting the potential of technology and risk management practices. Through a comprehensive overview and strategic insight, the piece aims to equip small to medium-sized fleet operators with the knowledge to navigate the complexities of insurance premiums in today’s fast changing market.

Overview of Insurance Premium Increases

Historical Data on Insurance Premiums

The landscape of auto insurance has seen significant changes over the past decade. According to the American Transportation Research Institute, commercial motor carriers have experienced a nearly 50% increase in per-mile insurance premium costs. This rise is further illustrated by data showing that truck insurance premiums escalated from 6.4 cents per mile in 2013 to 8.8 cents per mile in 2022. These trends highlight the growing financial burden on fleet operators, with small carriers being disproportionately affected.

Current Trends and Statistics

Recent years have continued to see steep increases in insurance premiums. For instance, ValuePenguin.com projects a nearly 13% surge in premiums for 2024, following an 11% rise in 2023. This trend is exacerbated by broader economic factors such as general inflation impacting vehicle repair costs and medical expenses related to accidents. The commercial auto insurance market has faced significant underwriting losses, prompting insurers to implement rate hikes, with some policyholders facing double-digit increases. These adjustments reflect the industry’s response to increased operational and claim costs, driven by factors like technological advancements in vehicles and the rising incidence of nuclear verdicts.

Factors Contributing to Rising Premiums

Several factors are influencing the rise in fleet insurance premiums, notably among small to medium-sized fleets. Firstly, litigation and legal settlements have become more prevalent and costly, with juries awarding higher compensations in accident-related lawsuits, often referred to as “nuclear verdicts.” Several notable examples of nuclear verdicts from the U.S. Chamber of Commerce’s Institute of Legal Reform include:

• In 2019, a jury in Oklahoma awarded $25 million to the family of a man who was killed in a collision with a semi-truck.

• In 2020, a jury in California awarded $55 million to the family of a woman who was killed in a collision with a semi-truck.

These substantial settlements increase insurers’ risks, leading to higher premiums for fleet operators.

Secondly, economic conditions and inflation also play a significant role. The general rise in prices affects vehicle repair costs and medical expenses, thereby increasing the average claim amounts that insurers need to cover. This inflationary pressure necessitates adjustments in premium rates to maintain insurer solvency.

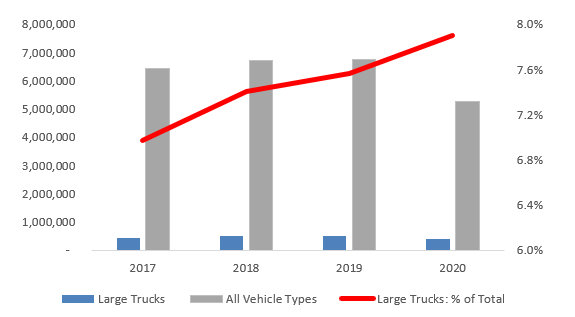

Finally, crash frequency and severity have an impact. An increase in the number of accidents or the severity of these accidents results in more claims being filed, which in turn puts upward pressure on insurance premiums. This is exacerbated by the higher costs associated with more technologically advanced vehicles, which are more expensive to repair. While large commercial trucks represent a small percentage of overall vehicle crashes, large trucks’ percentage of total crashes has been increasing year-over-year based on 2017 – 2020 crash statistics from the Federal Motor Carrier Safety Administration (FMCSA) as shown in Table 1 below:

Table 1

Total Crashed by Vehicle Type

Impact on Small to Medium Sized Fleets

Higher Costs per Mile for Small-to-Medium-Sized Fleets

Small-to-medium-sized fleets paid almost 2x per mile in 2020 premiums as large fleets and over 3x per mile as very large fleets based on American Transportation Research Institute’s (ATRI’s) analysis of “The Impact of Rising Insurance Costs on the Trucking Industry.” Insurance premiums represent the largest proportional disparity between small-to-medium-sized and large fleets’ marginal costs.

Table 2

Average Premium Costs per Mil

Normalized to 2020 Mileage

Operational and Financial Strains

Escalating insurance premiums impose substantial operational and financial strains on small-to-medium-sized fleets. Additionally, the financial burden may restrict the ability of these fleets to invest in technologies that can reduce risks and enhance safety profiles.

Strategies for Mitigating Insurance Costs

Telematics solutions have a demonstrable track record in reducing risks. Together for Safety Roads (TSR) completed a survey of over 500 professional drivers with the following examples of risk reduction:

- 25% of drivers indicated that avoid a crash due to in-cab alerts

- > 20% of drivers were exonerated from an accident claim based on in-cab footage

Adopting Dashcam Solutions

Implementing telematics solutions with dashcam technology is a pivotal strategy for mitigating fleet insurance costs. These systems not only record driving incidents but also proactively monitor driver behaviors, alerting drivers to correct risky actions in real-time. This continuous monitoring and the ability to provide concrete evidence during disputes significantly enhance fleet safety and can lead, with demonstrated risk reductions, to mitigating or eliminating premium increases.

Utilizing AI-Enabled Driver Scores

AI technology extends beyond mere recording, offering comprehensive insights into driver performance. By integrating AI-enabled dashcams with telematics, fleets can leverage detailed data to improve driver safety scores. As these scores improve, they reflect positively on the fleet’s risk profile, encouraging insurers to offer more favorable premium rates. This approach not only helps in cost reduction but also bolsters overall fleet safety.

Conclusion

Throughout this exploration, it has become evident that the rise in insurance premiums poses a significant challenge for small to medium-sized fleet operators, influenced by factors such as nuclear verdicts, the increase in operation and repair costs driven by inflation, and the pricier claims associated with technologically advanced vehicles. Yet, amidst these difficulties, the article has illuminated pathways to navigate through these rising costs effectively, underscoring the importance of embracing technological advancements like dashcams and AI-enabled driver scoring systems. These strategies not only offer potential for substantial savings on premiums but also elevate overall fleet safety, reflecting a proactive approach to risk management.

The significance of these findings lies not only in their immediate application, aiding fleet operators in mitigating financial burdens but also in their broader implications for the commercial transportation industry. As fleets adapt by integrating technology and refining risk management practices, the industry as a whole stands to benefit from reduced accident rates and enhanced efficiency. This shift towards technology-driven solutions and improved safety standards underscores a transformative approach in responding to the challenges of rising insurance premiums. Those operators who are forward-thinking in their adoption of these strategies may well navigate the uncertainties of the market with greater resilience and success, setting a benchmark for sustainable fleet management in an evolving insurance landscape.

About Positioning Universal

Established in 2013, Positioning Universal is the leading global provider of off-the-shelf and customizable IoT devices for vehicles and asset monitoring. Our Systems Integration (SI) services deliver turn-key solutions for smooth IoT implementations, leveraging our team’s extensive industry knowledge.

With a deep understanding of IoT technologies, we guide companies in designing and deploying IoT solutions that meet their unique needs. Our comprehensive offerings, paired with best-in-class customer support, empower businesses with the essential business intelligence to sustain a competitive edge in rapidly evolving markets.

Positioning Universal’s AI-Powered Dashcams

Driven by a real-time high-performance edge processing GPU, our AI-powered dashcams use AI algorithms and can actively monitor up to 5 cameras simultaneously. This includes detecting triggerable events such as alerting the driver about pedestrians, identifying dangerous driving violations like running red lights and stop signs, and much more. Telematics solutions using AI-powered dashcams with edge processing contribute to driver and public safety by capturing real-time footage and alerting drivers of potential hazards. With our cutting-edge technology, we are committed to fostering a safer driving environment and providing invaluable guidance and alerts in critical moments on the road.

Author

Geoff WeathersbyRelated posts

Total Asset Visibility and Protection for Powered and Non-Powered Assets

Introduction In industries ranging from transportation & logistics to health

Cellular Frequency Bands and their Impact on Telematics

On episode 2 of Well’s Words, Positioning Universal CEO Mark Wells briefly dis

Unveiling ChatGPT-3: Igniting AI Enthusiasm and Connected Car Technology Transformation

The release of ChatGPT-3, a generative AI model, by OpenAI in November 2022 spar