Tips for Selecting the Right IoT Devices

Introduction

The Internet of Things (IoT) ecosystem is a vast and dynamic landscape that encompasses a diverse array of components, spanning hardware, software, connectivity, and services. At its core, the hardware aspect of IoT involves a myriad of devices such as sensors, smart devices (i.e., home speakers), and vehicle/asset trackers. These devices facilitate the collection and transmission of data, forming the foundation of the entire ecosystem. On the software and platforms front, a multitude of solutions exist to manage, analyze, and interpret the massive influx of data generated by IoT devices. Connectivity plays a crucial role, with various protocols such as Wi-Fi, Bluetooth, Zigbee, Cellular, and Satellite networks enabling seamless communication between devices. Additionally, services like Data Analytics, IoT Security, App Development, and Systems Integration contribute to the overall functionality and value proposition of the IoT ecosystem, offering a comprehensive and interconnected framework that extends across industries and applications.

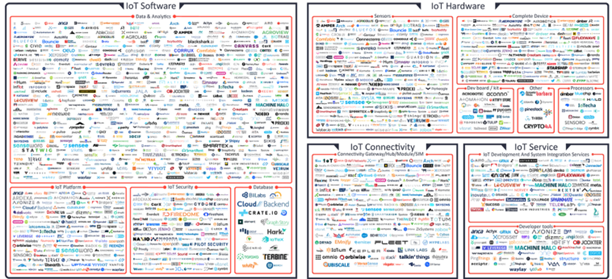

This vast IoT ecosystem can be illustrated by the 2021 IoT Startup Landscape developed by IoT Analytics. This landscape graphic includes over 1,000 startup companies offering solutions across software, hardware, connectivity, and services.

Table 1

IoT Analytics : 2021 IoT Startup Landscape

Source: IoT Analytics

While it’s tempting to explore all facets of the IoT ecosystem, this blog focuses on how to select the right IoT (or GPS) devices as the foundation for the success of any IoT project.

Background

Global GPS Tracker Market

According to 360 Research Reports, the global GPS Tracker market is forecast to increase from $1.5 billion in 2022 to $2.9 billion by 2028. The global top five GPS tracker manufacturers are Jimi IoT, CalAmp, Queclink, Teltonika, and Meitrack. These manufacturers account for 55% of the market. China is the leading global producer of GPS trackers with 65% market share.

Table 2 provides a list from 360 Research Reports of the leading GPS manufacturers which are grouped by headquarters location:

Table 2

Leading Global GPS Device Manufacturers

U.S. | China | Other |

● CalAmp ● Sierra Wireless ● Positioning Universal ● Danlaw | ● Jimi IoT ● Queclink ● Suntech ● Thinkrace Technology ● Eelink ● TOPFLYTech ● Coban | ● Teltonika ● Sensata (Xirgo1) ● ARKNAV ● Ruptela ● Navtelecom |

1 Xirgo, based in the U.S., was acquired by U.K.-based Sensata Technologies (NYSE: ST) in February 2021

Aftermarket Vehicle Telematics Market

One of the key segments within the Global GPS Tracker market is Aftermarket Vehicle Telematics. Berg Insight estimates that global sales of aftermarket telematics devices surpassed 47.2 million in 2022, generating a market value of € 2.4 billion. Their forecast indicates that annual shipments of aftermarket telematics devices will reach 77.6 million in 2027, generating a market value of € 8.4 billion.

The leading aftermarket vehicle telematics companies identified by Berg Insight in their recent report are listed in Table 3 below:

Table 3

Leading Global Aftermarket Vehicle Telematics Providers

North America | Asia Pacific | Europe/Other |

● CalAmp ● Positioning Universal ● Danlaw | ● Jimi IoT ● Queclink ● Suntech ● Gosuncn RichLink ● Neoway Technology ● Gosafe ● Kingwo ● ATrack ● iTriangle | ● Teltonika ● Sensata ● ERM Advanced Telematics ● Meta System ● Ruptela ● Munic |

IoT Device Selection: Key Decision Factors

The diversity of IoT devices options, as evidenced by the Startup Landscape in Table 1, makes the decision-making process for the selection of devices crucial for achieving project objectives and return on investment (ROI) targets. Whether designing a smart city infrastructure, optimizing industrial processes, or streamlining supply chain logistics, IoT device selection requires thorough evaluation of the following factors:

Table 4

Key Decision Factors

Key Decision Factors | Description |

Intended Purpose / Use Case | ● Type of asset: vehicle, trailer, industrial equipment, portable light towers, etc. ● Type of device: hard-wired, battery-powered, solar-powered, etc. ● Duration: weeks vs. months vs. years ● Data use/storage period: tracking frequency, vendors data retention policy, etc. ● Operating Environment: indoors, outdoors, temperature extremes, water/dirt exposure, remote locations, etc. |

Off-the-Shelf vs. Custom | ● Device fit with intended use case / requirements ● Potential trade-offs between costs/availability vs. fit |

Device Design & Specifications

| ● Form Factor: size based on asset type and installation requirements ● Enclosure: IP rating, ruggedized ● Processor/Processing Power: real-time tracking, near real-time, periodic ● Memory: RAM for on-device data storage and over-the-air software updates ● Battery: type, capacity/lifespan, rechargeable/replaceable vs. one-time use ● IMU: 3-axis, 6-axis, or 9-axis accelerometers |

Connectivity | ● LAN, PAN, WAN, LPWAN, Satellite ● Built-in or add-on connectivity options: Wi-Fi, Bluetooth, etc. |

Security | ● Device: source-code analysis to detect security defects, encryption, privileged access, etc. |

Power | ● Power consumption requirements based on tracking frequency, add-on sensors, etc. ● Powered vs. Non-Powered Assets |

Firmware | ● Over-the-Air (OTA) updates: availability and frequency of updates ● Security: device authentication, encryption |

Costs | ● Pricing model: up-front hardware + monthly/annual recurring fees; monthly/annual recurring fees with no up-front costs, etc. ● Total Cost of Ownership (TCO): TCO includes the hardware costs plus the cost of recurring fees including connectivity, platform & storage fees, map fees, etc. |

Note: the Key Decision Factors in Table 1 focus on device-specific criteria and, as a result, exclude a Vendor Evaluation.

Tips

Since IoT devices form the cornerstone of a successful IoT deployment, ensuring the accurate selection of the right device is crucial. While there is a comprehensive list of key decision factors outlined in Table 4, this blog provides an in-depth view of three of these decision factors: Off-the Shelf vs. Custom, Battery Performance within the Device Design & Specification, and Connectivity.

Off-the-Shelf vs. Custom

In addition to evaluating capabilities of the device components, such as processing power and memory, it’s also imperative to determine up front whether to purchase an off-the-shelf device or build a custom version. While there is less risk in using an already available and tested device, there may be unique requirements that can only be satisfied by building a custom solution. Key questions to ask to evaluate the off-the-shelf vs. custom option include:

● What is the prospective vendor’s track record for building custom solutions?

● Does the vendor have an Agile Manufacturing philosophy which includes the use of flexible manufacturing lines?

● What are the vendor’s lead times ranges for building custom solutions?

● What are the one-time development costs?

Refer to our blog, “Unlocking the Power of Mass Customization: Discover Personalized Solutions with Positioning Universal,” for additional information.

Device Design & Specifications: Battery Performance

Many GPS devices are now battery-powered or rely on backup batteries for power so the device can continue to operate in the event it becomes disconnected from a constant power source. While IoT device vendors provide guidance on the expected battery life of their devices, this guidance should be provided by vendors as a range given variability in tracking frequency/usage and operating environments. As an example, extreme temperatures variations will cause batteries to lose capacity more quickly, while high humidity may impact the performance of electronic components within devices.

Battery degradation can lead to infrequent tracking if the battery reaches critical low battery thresholds and, in the worst case scenario, batteries in devices may die or require recharging/replacement well before the vendor’s battery life guidance.

Any gaps between advertised and actual battery life will drive higher deployment costs such as the cost of personnel to replace or recharge the batteries or to prematurely replace the IoT device if designed for one-time use. This gap becomes particularly acute for applications where long-term, unattended operation is crucial.

One crucial aspect to consider while evaluating battery and overall performance of IoT devices is to understand the lab and field testing completed by IoT device vendors. Key questions to ask include:

● What was the scope of the Lab and Field testing? Temperature Extremes? Humidity?

● How long were the devices tested before their commercial launch?

● How long have the devices been commercially available?

● What was the geographic footprint for the field testing to ensure devices were tested in places with limited cellular coverage and extreme temperatures variances?

Battery performance is particularly important for successful long-term IoT deployments using battery-powered devices. Variability in tracking frequency and environmental conditions impact battery life, potentially leading to accelerated battery degradation. Rigorous lab and field testing is essential for understanding a device’s resilience and ensuring accurate battery lifespan expectations while mitigating costs to replace or recharge batteries or to replace one-time use devices with depleted batteries.

Connectivity

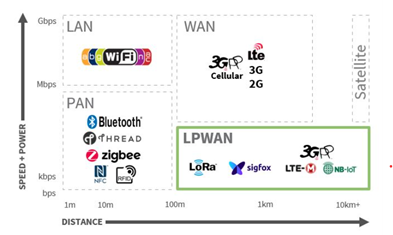

As the IoT landscape continues to rapidly evolve, an array of connectivity options has emerged, each catering to specific use cases and requirements. Table 5 provides an overview of these options which include Local Area Network (LAN), Personal Area Network (PAN), Wide Area Network (WAN), Low Power Wide Area Network (LPWAN), and Satellite. It should be noted that the LTE options within WAN in the chart below now include 4G and 5G.

Table 5

Connectivity Options

Source: Allion

The emergence of satellite connectivity is opening exciting new possibilities for global coverage, remote applications, and less expensive connectivity. These emerging technologies include new GPS III satellite technology being deployed in the Middle Earth Orbit (MEO) constellation and the rapid increase in the number of IoT connectivity services being offered in the Low Earth Orbit (LEO) constellation. Refer to our blog, “How Satellite Constellations Are Shaping Our World,” for additional information.

While selecting the right IoT devices, another key factor is understanding the available connectivity options offered by potential vendors. This is especially vital because connectivity costs often constitute a substantial portion of the Total Cost of Ownership (TCO), especially for devices with multi-year deployment requirements. Key questions to ask include:

· What connectivity options are offered by prospective vendors?

· What emerging connectivity options, such as satellite-based options, are currently offered or are being considered by prospective vendors which may lower the TCO?

IoT Connectivity costs are often the most material cost of an IoT program especially for use cases which require real-time or near real-time tracking & monitoring, use of dashcam videos, and/or require multi-year monitoring requirements. For these use cases, it’s important to determine if prospective vendors offer multiple connectivity and different data usage tier options.

Conclusion

Navigating the challenge of selecting the right IoT device requires a thorough consideration of the key decision factors outlined in this blog. Whether determining whether to buy an off-the-shelf device or build a customized IoT solution, understanding battery performance considerations, or determining the best connectivity option, these tips offer a guide for choosing the device(s) best suited to ensuring successful IoT deployments. Refer to our blog “Overcoming IoT Implementation Challenges: Tips for a Successful Deployment” for additional information.

Positioning Universal Viewpoint

Established in 2013, Positioning Universal is the leading global provider of customizable IoT hardware devices and GPS vehicle and asset monitoring solutions.

With a deep understanding of IoT technologies, Positioning Universal guides companies in selecting the most suitable IoT devices for their needs. By leveraging our expertise, companies can optimize device performance, ensure data accuracy, and enhance the performance of their IoT solutions. This empowers businesses with the invaluable business intelligence needed to maintain a competitive edge in rapidly evolving markets.

Author

Jennifer CurleyRelated posts

Cellular Frequency Bands and their Impact on Telematics

On episode 2 of Well’s Words, Positioning Universal CEO Mark Wells briefly dis

The Evolution of IoT Device Connectivity

Introduction As the Internet of Things (IoT) continues to expand, the importance

The Advantages of a Dual-Facing Dashboard Truck Camera

In the fleet management sector, dash cameras have proven to be more beneficial t